And that same data, which comes from Opensignal, shows that Vodafone is having a tough time compared with its peers, failing to win in any of the many categories the experience analysis specialist monitors. That said, the telco is a solid number two in half of them, so that’s something.

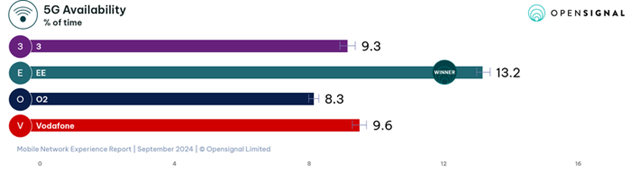

UK smartphone users have a 5G network available to them around 10% of the time, according to Opensignal. That 5G availability metric is arguably more important than coverage measures, since it gives a clearer picture of what customers are actually experiencing when they pick up their smartphone.

Overall network availability – on 3G, 4G and 5G – is pretty high in the UK; all operators came in above 95%, although in Vodafone’s case, only just. 5G availability is naturally much lower and in this latest Opensignal report, which covers the three months to the end of August, ranged from 13.2% for EE at the top of the pile down to 8.3% for O2 in fourth.

This time last year the telcos were all between 10.6% and 10%. That’s a decent increase for EE, perennially leading the UK experience market, but a small slide for the other three.

Opensignal made no comment on the change, which perhaps suggests that there are reasons why the data might not be comparable. Alternatively, it could be that, as they increase their 5G customer bases, the UK’s mobile operators – or at least three of the four – need to pay attention to the experience those customers receive.

As far as EE is concerned, this was yet another Opensignal experience report in which it outstripped its competitors in most categories. There are 14 in total, covering overall speed, video and gaming experience, consistency and so forth. EE scooped 10 this time, which is slightly better than it did a year ago, when it shared three of the 10 with rival Three.

Three UK is still performing well though, winning out in terms of 5G upload and download speeds, and overall availability. That left just one award for O2, which has the best coverage experience in the UK; essentially, that means geographic coverage of populated areas where customers would expect to be able to use their phones.

Vodafone wins nothing. But, as Opensignal pointed out, it came in second in seven categories, including three of the four overall experience awards and both consistency awards.

Opensignal reminds us that the proposed Vodafone/Three tie-up is “looming over everything” in the UK, pointing to its own recent analysis of the market that shows the merged entity would have comparable coverage experience to O2, potentially stripping that operator of its one award in future reports. It also reminded us that Three is having a tough time in the market, highlighting some data it published last month that essentially casts doubt on the operator’s ability to compete in its own right. It had nothing to add on that score though.

The Competition and Markets Authority (CMA) is due to rule on the merger in December.

In the meantime, the UK market is set for further change. EE and Vodafone completed their 3G shutdowns in February, with Three due to follow suit before year-end; O2 is hanging on until 2025.

Closing down their 3G networks should help operators improve their customers’ smartphone experiences, since it frees up spectrum to help address congestion on other networks. Future Opensignal reports will give us some idea whether that, plus the broader launch of 5G standalone – EE went to market earlier this month – will have a bearing on what customers actually experience when they pull a device out of their pocket.

يمكن الاطلاع على المقال الأصلي على: