While MediaTek is Qualcomm’s biggest industry challenger, comparing the two companies as rivals is a bit of an apples-to-oranges situation as they focus on different price tiers in the 5G smartphone market.

MediaTek is outpacing Qualcomm in gaining 5G smartphone market share, according to research group Omdia, a Light Reading sister company. This shift is largely due to the increased availability of “phones priced under $250 equipped with 5G chipsets – a segment dominated by MediaTek,” said Omdia.

Within this growing segment of low-priced smartphones are devices with increasingly impressive hardware for the price point. Electronics maker Nothing, for example, launched its first smartphone this month – the CMF Phone 1 – for $199. Nothing’s phone includes a MediaTek Dimensity 7300 5G chipset plus an Android 14-powered OS, dual-SIM capability, 8GB of RAM and 128GB of storage.

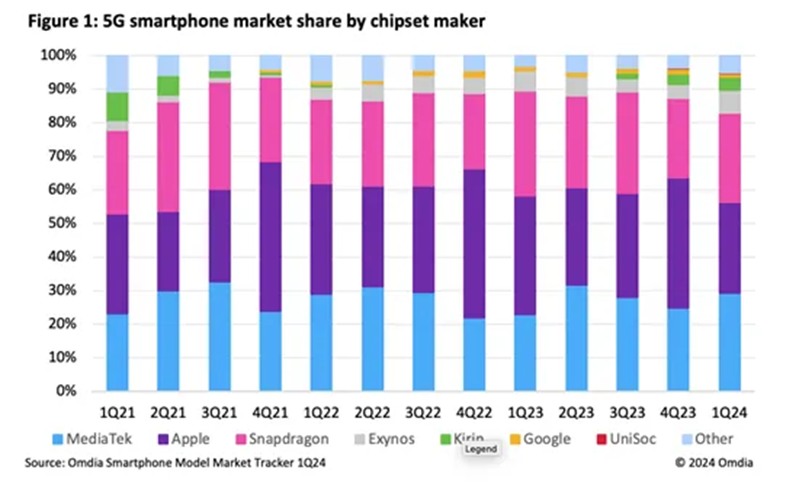

(Source: Omdia Smartphone Model Market Tracker 1Q24)

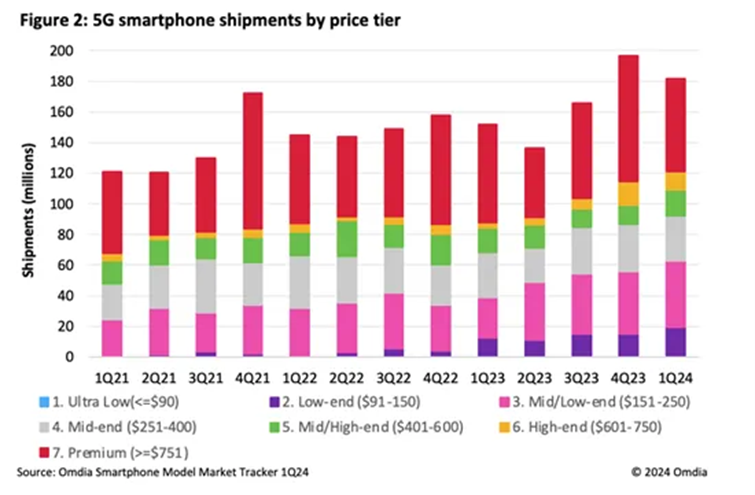

Shipment of low-end priced smartphones – under $150 – increased by 30 million year-over-year, from 90 million in Q1 2023 to 120 million in Q1 2024, an uptick of 33%, according to Omdia. This shift comes in large part from mid-end smartphone buyers upgrading or downgrading their phones.

MediaTek and Qualcomm’s rivalry is complicated

MediaTek’s focus on the mid to low-end price tier “comes from their portfolio of chipsets but also through their longstanding ties and links with Chinese smartphone OEMs such as Transsion and Xiaomi, which also specialize in that price tier,” Aaron West, senior analyst in Omdia’s Smartphone group, told Light Reading in an email. “Qualcomm has arguably done a better job, however, in being cutting-edge and building a reputation with both vendors and consumers for producing the best chipsets.”

West added that MediaTek is focused on the cheapest new 5G phones, and Qualcomm Snapdragon leads in the mid-range 5G smartphone category, with phones priced above $400. Apple tops the premium segment with the company’s iPhones and A16 and A7 chips.

“But as Apple is its own separate ecosystem, it is not in true competition with the others in this space,” said West. “If you’re just looking at Android phones, Qualcomm Snapdragon with its 8 Gen 2 and Gen 3 chips are the top premium chipsets.”

(Source: Omdia Smartphone Model Market Tracker 1Q24)

Figure 2 shows that shipments of 5G smartphones below $250 increased by 62%, from 38.7 million in Q1 2023 to 62.8 million in Q1 of this year.

Update: Omdia’s data in this report tracked application processors (AP). It does not include 5G modems in iPhones that Qualcomm supplies.

MediaTek’s 5G smartphone market share has increased from 22.8% in Q1 2023 to 29.2% in Q1 of this year. By comparison, Qualcomm Snapdragon’s market share dropped from 31.2% to 26.5% over the same period, according to Omdia.

Shipment of 5G smartphones with MediaTek chipsets grew 53% year-over-year, increasing from 34.7 million in Q1 2023 to 53.0 million in Q1 2024. On the other hand, 5G smartphones with Qualcomm’s Snapdragon chips experienced nominal growth with 48.3 million shipments in Q1 2024, compared to 47.2 million units in Q1 2023.

However, comparing MediaTek and Qualcomm as rivals is a bit of an apples-to-oranges situation as they focus on different price tiers in the 5G smartphone market.

“While MediaTek is the biggest industry rival to Qualcomm, I don’t think they necessarily challenge one another hugely,” said West. “This is due to the how Qualcomm Snapdragon chips are the go-to for premium phones, and Qualcomm’s bread-and-butter, while MediaTek have a richer mid-to-low end range of chipsets. MediaTek has repeatedly tried to make gains in the premium segment, with their latest 9000 series of chips, but doesn’t have the same reputation Snapdragon has in this.”

“MediaTek stands to benefit the most” from the increased affordability of 5G technology that’s being integrated into the low-priced tier of smartphones, said West. However, on-device AI features are gaining importance to smartphone OEMs “with Snapdragon emerging as a key innovator and preferred choice for premium devices.”

Trade tensions stir up the chipset market

“Other chipset manufacturers, such as Exynos, Google, Kirin and UniSoC collectively account for 17% of shipments,” said Omdia. Kirin’s growth, in particular from the Huawei Mate 60 Pro and Nova 12 series, has played a significant role in increased market share from these manufacturers.

However, after HiSilicon’s announcement to end Kirin chipset production from September 15, 2020, during trade tensions between Huawei and the United States, the Kirin 9000s chipset concluded its production in August 2023, said Omdia. HiSilicon is Huawei’s in-house chips division.

As chipset manufacturers, such as Apple, Exynos and Snapdragon, have moved away from producing 4G chipsets in favor of 5G chipsets, UniSoC has increased its share of the 4G market and is now MediaTek’s primary competitor in that sector. Exynos, for example, reduced its 4G chipset shipments significantly from 77% of smartphone shipments in Q1 2021 to only 1% in Q1 2024. MediaTek, on the other hand, still uses 4G chipsets for over 50% of its shipments.

US-based Qualcomm had a one-up on MediaTek with a license to sell 4G chips to Huawei, reported Light Reading’s Iain Morris.

“Unlike MediaTek, a Taiwanese rival, Qualcomm secured an export license to sell 4G chips to Huawei in late 2020, just before a change in US administration,” wrote Morris. “An authoritative source estimates Qualcomm has made about $1.2 billion from chip sales to Huawei since receiving that license.”

Unfortunately for Qualcomm, this license doesn’t allow it to sell 5G chips to Huawei, and the market for 4G chips is diminishing. “In a world turning to 5G, this means the value of the license has been diminishing fast, especially since Huawei’s revelation of its own 5G chip in September last year,” reported Morris.

يمكن الاطلاع على المقال الأصلي على: