Private cellular networks based on 4G technology have been around for a decade. But cloud-native 5G opens the private cellular market to service a variety of exciting new applications. That’s because the 5G mobile standard is packed full of features – like network slicing and security – that make it a perfect fit for deployment in verticals such as utilities, mining, manufacturing and transportation – as well as applications that have yet to be discovered, designed or deployed.

5G’s deployment in support of these applications is redefining the mobile standard as something more important than just a new and faster “G” for consumers. In its new guise, the technology is an enabler of the Industry 4.0 revolution. However, this role is placing a new set of expectations on the internal company teams who must deploy 5G.

That “business first” tech model is an uncomfortable fit for IT departments, which are more used to dealing with bits and bytes than dollars and sense. They have decades of experience with IP network metrics like mean time to failure and data speed; now they’re expected to know how their network can positively influence total cost of ownership (TCO), total effective equipment performance (TEEP) or return on assets (ROA).

“They’re comfortable with the IT role, but private cellular is a whole new world for them,” said Bart Giordano, president of networking, intelligent cellular and security at CommScope.

Private Party

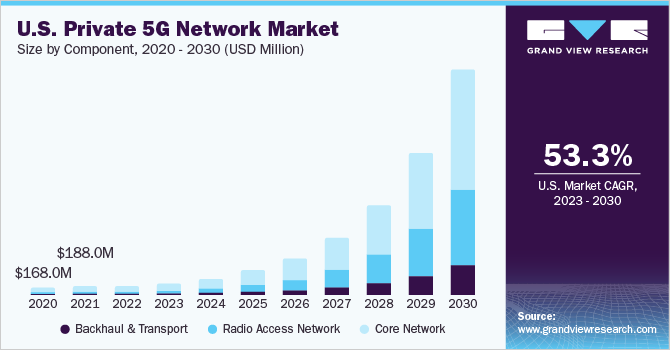

The market opportunity for private 5G networks is massive and growing. According to Grand View Research the global private 5G network market size was valued at $1.61 billion in 2022 with a compounded annual growth rate (CAGR) of 51.2% from 2023 to 2030. (See chart below.)

CommScope is one of a slew of companies with business units focused on helping companies build and manage private cellular networks.

Ericsson and Nokia both used this year’s Mobile World Congress event in Barcelona to announce strategies targeting private 5G.

In addition, private 5G is one of the main offerings from Rakuten Symphony, a company specializing in building cloud-native 5G around the world. Rakuten Symphony’s Symworld operating platform includes capabilities designed to take some of the pain out of managing private 5G networks by allowing IT departments to implement zero-touch automation.

Private 5G is also a major market play for Samsung.

“Our focus is on making carrier-grade solutions available within the enterprise,” David Kim, director of network enterprise sales, Networks Division, Samsung Electronics America, told Silverlinings.

The company’s Compact Core is a scaled down version of its telco 5G solution designed for use in private 5G enterprise networks.

5G headwinds

For all the growth in private 5G, there are still some factors delaying its uptake. One is the relative paucity of off the shelf industrial equipment with built in 5G transmitters. Another is the lack of consensus over which APIs to use to integrate industrial applications over cloud-native 5G.

Then there’s the 5G spectrum itself, which has to be licensed by the company using it. And finally, deploying 5G in vertical industries often requires companies to wrangle truly bleeding edge technologies like artificial intelligence (AI), machine learning (ML), sensors and so on.

It’s not surprising, given all the above, that many customers are looking to outsource the challenges to a managed service provider. Kyndryl (the IBM spin-out) specializes in supporting private 5G implementations. Samsung bought network services provider TeleWorld Solutions to support enterprises and telcos looking to deploy 5G.

Horses for courses

Given all the excitement about private 5G, is it possible that it might one day supersede WiFi technology in corporate and industrial networks? That’s unlikely, experts say.

“WiFi enjoys the reality of a massive scale ecosystem,” Alok Shah, vice president, networks strategy, business development and marketing at Samsung Electronics America, told Silverlinings.

For the foreseeable future, both technologies will co-exist, he said.

(Just to make things more interesting, companies deploying IoT applications may also have to fold other specialist low-power wireless protocols into their networks, such as Zigbee and BLE.)

Deciding which wireless technology to deploy, for what, means playing to their strengths. WiFi is cheap and ubiquitous, but cloud-native 5G has vastly superior security and much better coverage, allowing mobile users to roam effortlessly around a campus or factory floor and beyond.

Safety is another of 5G’s gifts. Cellular spectrum is licensed, which, along with cloud-native 5G’s network slicing capabilities, means it can be dedicated to specific applications. With WiFi, on the other hand, data from different sources can create service contention.

This guaranteed service availability is important in applications involving heavy equipment, AGVs (automated guided vehicles), or the precisely controlled lowering of a zirconium fuel rod containing fissionable material into a nuclear reactor core, where a network outage could potentially lead to the total destruction — BOOM! — of an area the size of Detroit.

Indeed, all of the gifts of cloud-native private 5G services are where the money is at for service providers hoping to monetize their 5G investments – and they are finally beginning to realize it.

“Companies can build a network, but they’d generally prefer to buy an SLA [from a managed service provider],” said CommScope’s Giordano. “Our goal is to make the whole thing turnkey for them.”

يمكن الاطلاع على المقال الأصلي على: