T-Mobile released a report today that seeks to answer some of the questions around fixed wireless access (FWA) and why people are ditching cable for FWA.

Of course, the report is complimentary for T-Mobile, but there’s no denying that the main players in FWA – T-Mobile and Verizon – are seeing sizable growth.

In a somewhat atypical way, T-Mobile doesn’t bash Verizon in the report quite as much as one might have come to expect. It notes that combined, they’re looking to serve 11 million to 13 million total FWA customers by 2025.

T-Mobile now boasts more than 2 million internet customers, and it just started offering the service about a year and a half ago. T-Mobile’s 5G Home Internet service is available to more than 40 million homes. Verizon’s 5G FWA service is available to about 30 million homes; it has more than 1 million FWA users.

The report was compiled by T-Mobile using its own data about its customers as well as some third-party, publicly available information, a spokesperson said. It includes usage trends, where customers are coming from, how customers rate the FWA experience and audience demographics.

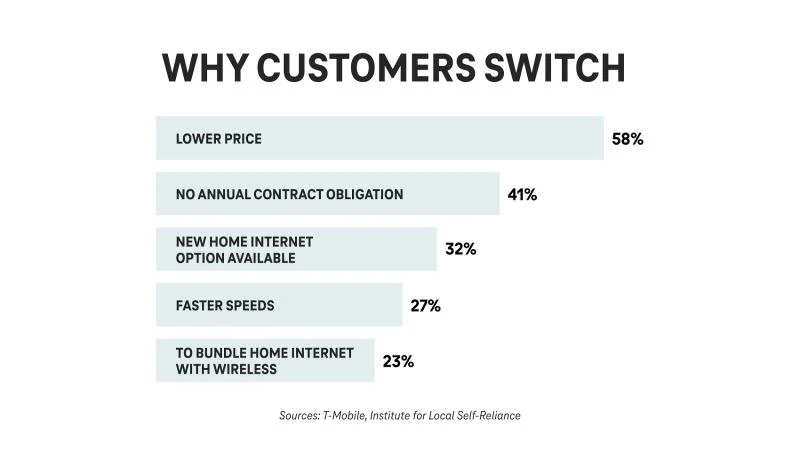

T-Mobile customers list a lower price and no annual contract as leading factors for switching. (T-Mobile)

Some 93% of T-Mobile Home Internet users are on postpaid accounts, with 7% on prepaid. More than half of T-Mobile’s FWA customers are coming from cable; the breakdown is 49% from “other,” which includes satellite, DSL or areas with no previous provider and 51% from cable.

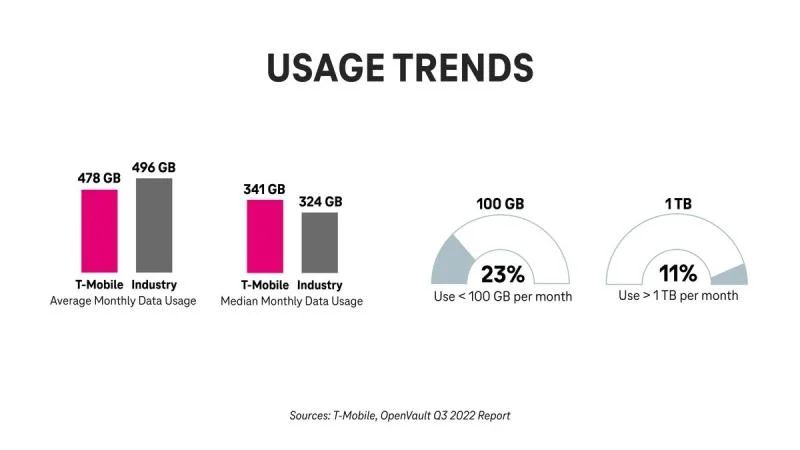

On average, T-Mobile Home Internet users are most active in the evening, between 6 p.m. and 12 a.m., with usage peaking around 9 p.m. The average monthly data usage is just over 450 GB, with median usage just over 330 GB.

T-Mobile’s VP of Marketing for the Emerging Products Group, Kaley Gagnon, presented a keynote at the Fierce FWA Summit on Tuesday. She said cable is the “most hated industry” today, and T-Mobile sought to change the backwards practices that traditionally permeated the industry, including price hikes and complicated, lengthy installations.

Unlike how cable companies have required wireless subscribers (acquired via MVNOs) to be a broadband customer, T-Mobile does not require fixed wireless subscribers to be mobile customers. Almost half of its Home Internet activations are customers who are brand new to T-Mobile, she said.

One thing that T-Mobile likes to tout is its lower data plans for people who don’t want to pay the higher prices for bigger buckets of data that they don’t actually need. Last summer, T-Mobile launched its Home Internet Lite plan, which comes at a lower price and is aimed at people who aren’t power users.

Facebook is the top social platform for fixed wireless customers, with Instagram a close second. (T-Mobile)

While a lot of the competition is talking about gigabit speeds and all that offers, not all consumers want or need that kind of service. For a lot of people, “you really don’t need a gig,” and “the onus is on us” to educate consumers about what they’re paying for and why. Put another way: Unless you’re mining for bitcoin, “you don’t need that,” she said.

T-Mobile is offering perks for FWA customers as well, similar to what mobility customers get. One of the top applications for FWA is streaming video, so giving them related benefits, like “a year of Paramount Plus on us,” is one way of encouraging people to use the service, she said.

What about capacity?

T-Mobile and Verizon executives routinely are asked if their networks can handle all the demands of FWA alongside their mobile customers as the same networks serve both. Are FWA users going to overload the networks that are so lucrative from a mobile perspective?

Both Verizon and T-Mobile executives have said they don’t expect capacity problems now or in the future.

Gagnon said that T-Mobile is proud because its 5G network enables it to deliver capacity on this scale and not get crushed by the heavy usage. It’s also very scientific and specific about how it determines customers’ eligibility for the service, as Gagnon previously explained.

“I can’t underscore enough the value that the team provides in really modelling the full usage across mobile and home broadband subscribers, not just today, but into the future – forecasting for these killer applications that are going to drive more usage and how do we make sure that we’re saying ‘yes’ and delivering this product to consumers for a great experience today and into the future,” she said.

“Demand has really blown us away,” she said. “We’re continuing to evolve” and increase the capacity to keep its sophisticated eligibility model up to date.

One more thing

Alas, it’s the fourth quarter and there’s still marketing to be done. T-Mobile has yet another deal to entice customers. Starting on December 8, for a limited time, new T-Mobile Home Internet customers can sign up at $25/month when they have one or more voice lines. T-Mobile says it will cover up to $750 on any earlier termination fees to help customers break up with their current provider.

يمكن الاطلاع على المقال الأصلي على: