August can be a slow time for news and a chance to relax and think big thoughts. So, perhaps you’re lounging on a beach somewhere and pondering questions such as: What ever happened to RedCap?

Well, the short answer is: It’s being hindered by the slow rollout of 5G standalone (SA) core networks. But it might also be hindered by the fact that enterprises like their Internet of Things (IoT) ecosystem to be simple, without constant updates.

Reduced Capability (RedCap) refers to a 3GPP standard that holds a lot of promise for the IoT ecosystem. It fits between the high capability of 5G networks and low-capability networks that simply connect a bunch of sensors. Fierce Network first reported about it last year when AT&T said it had conducted a 5G RedCap data call on a live 5G SA network. (Although it should be noted that AT&T has not rolled out 5G SA across its whole network.)

Earlier this summer, AT&T said it’s using RedCap commercially in select areas of Dallas. AT&T is working with both Ericsson and Nokia on its RedCap rollout.

But why aren’t we hearing much about the technology from other operators?

Joe Madden, chief analyst with Mobile Experts, suspects that the slow uptake of RedCap has something to do with the fact that it operates on a 5G SA network, and there just aren’t that many of those, yet. “It’s kind of waiting for operators to invest in a standalone core,” said Madden.

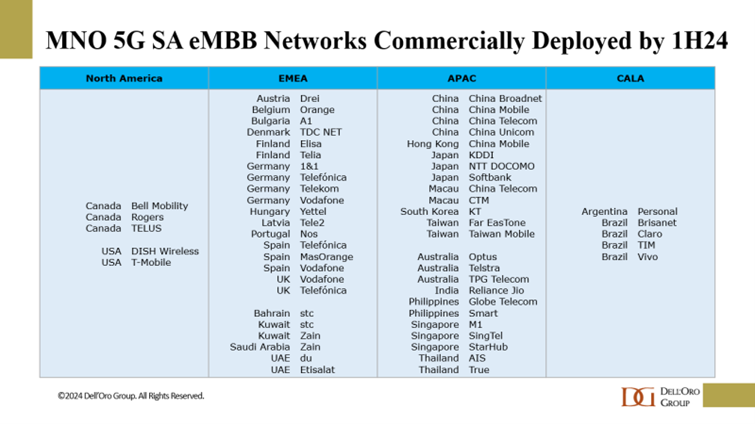

Dave Bolan, research director with the Dell’Oro Group, said 5G SA has been deployed in 30 countries by 58 mobile network operators (MNOs). Three MNOs have launched new 5G SA networks in three countries in the first half of this year. According to Dell’Oro’s 5G SA tracker, only T-Mobile and Dish in the U.S. boast 5G SA cores.

Perhaps the slow pace of 5G SA deployments is part of the broader theme in wireless right now. “We have this downturn in the industry,” said Madden. “It’s all doom and gloom.”

5G has not delivered much real revenue to compensate for its heavy capital cost, so operators that haven’t already updated to 5G SA cores aren’t in a big hurry to do so. “It’s still in its early days,” he said “But it’s a bit of a chicken and egg problem. If you’re an operator who has not yet invested maybe you’ve slowed down.”

Madden said there’s another problem for RedCap, and that is “IoT is a mess.” He said the wireless industry puts out new standards every 18 months, and a lot of times it’s just fine-tuning. But enterprises hate that.

Viet Nguyen, VP of Public Relations & Technology for 5G Americas, said LTE-M and narrowband IoT (NB-IoT) are legacy technologies, while RedCap takes IoT into the modern age with 5G and “really gives a long tail of great technology for efficient use of bandwidth.” He added, “It’s definitely an exciting opportunity for companies because this is a continuation of other technologies that have used narrow spectrum bands.”

RedCap was specified in 3GPP Release 17, and there were also some updates to it in Release 18, which was just completed in June 2024. Nguyen said updates include some advanced power-saving techniques and some improvements to deployment flexibility.

“There’s a lot of testing that has occurred, particularly outside the U.S. in Asia,” said Nguyen. “Bharti Airtel in India has worked with Ericsson. Several Middle-East operators have been looking at some of those systems. A lot of the IoT market resides in Europe.”

Could RedCap be used for fixed wireless?

Madden raised an interesting idea, suggesting that perhaps RedCap would be a good technology for fixed wireless access (FWA) customer premise equipment (CPE). He said it might make sense in poorer countries where FWA is being deployed to bring internet to people who don’t have a lot of money for expensive CPE.

Fierce checked with Jim Neville, SVP and general manager of Mimosa, which is part of Radisys, a wholly-owned subsidiary of India’s Reliance Jio. Mimosa is helping Jio to deploy FWA broadband to customers in India.

But Neville said RedCap wouldn’t work as CPE for Jio’s AirFiber program because it uses unlicensed spectrum, rather than licensed spectrum that’s used for FWA that conforms with 3GPP standards. Neville said the type of FWA being deployed in India is more like the technology that WISPS in the U.S. deploy.

Madden said, “Mimosa and other companies are using unlicensed bands for fixed wireless, now. That’s an initial start. I think they’ll need to use multiple bands when SA core and RedCap are in play in India and that will be a good option.”

He noted that India’s population is 1.4 billion, and they all want broadband internet to their homes, and there’s hardly any fixed infrastructure.

يمكن الاطلاع على المقال الأصلي على: