Telecom carriers and analysts have been talking about lower capital expenditures (capex) for 2023, so it’s no surprise that Dell’Oro Group released a report on Tuesday citing a decline in worldwide telecom spending in 2023.

Apparently, the decline is going to continue for a while. Global telecom capex is projected to decline at a 2% to 3% compound annual growth rate (CAGR) over the next three years, as positive growth in India will not be enough to offset sharp capex cuts in North America, Dell’Oro said in a press release.

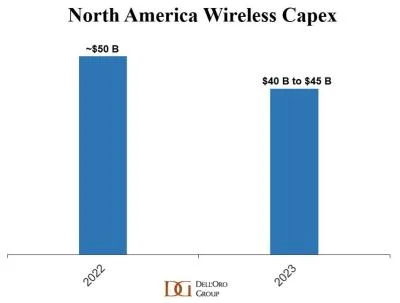

For wireless, the market research firm is now modelling capex in the North America region to decline 10% to 20% in 2023, said Dell’Oro Group analyst Stefan Pongratz.

Part of that has to do with the state of 5G rollouts. With the upper mid-band spectrum available nearly nationwide, operators are in a better position to scale back investments, he told Fierce.

More spectrum in the nation’s pipeline and wider bandwidths will be critical to justify another major capex cycle; spectrum efficiency gains alone likely will deliver minimal improvements, he noted.

Verizon + T-Mobile = biggest drop

Analysts at Mobile Experts are also tracking a decline in capex for North American operators this year, from $65 billion to $59 billion. Verizon and T-Mobile represent the majority of the drop, as they’ve wrapped up their 5G deployment surge and entered a phase of extending the network at a slower pace, said Mobile Experts chief analyst Joe Madden.

Capex and base station deployment are not tightly correlated, but in this case, the drop in capex will align with a roughly 10% drop in high-power base station deployment in North America, he said via email.

He also noted that Mobile Experts doesn’t use capex guidance from the operators as the main input to their forecast because the connection between capex and radio deployment is constantly changing. Instead, they rely on component shipments and backlog, capacity modelling and input from network vendors to predict the next 12 months.

During Verizon’s last earnings call, CEO Hans Vestberg said capital spending was expected to drop significantly in 2023, from $23.1 billion in 2022 to around $19 billion, a reduction of nearly 20% year over year. In 2024, Verizon expects its capex to be around $17 billion – among the lowest in the industry.

AT&T has said capital investment in 2023 would be consistent with 2022 levels, or about $24 billion, while T-Mobile expects capex to be between $9.4 billion and $9.7 billion in 2023.

يمكن الاطلاع على المقال الأصلي على: