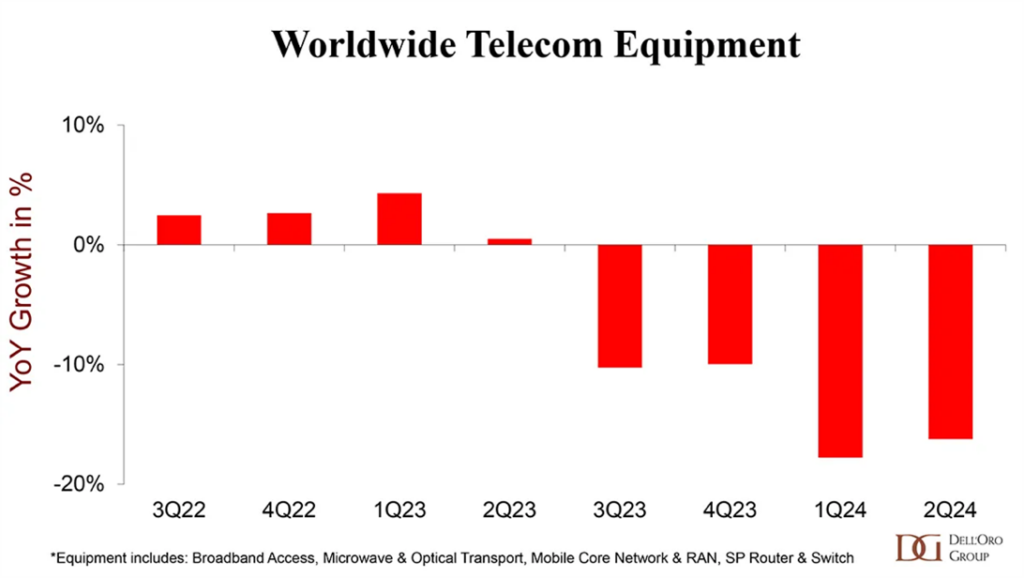

Telecom equipment revenues fell by 17% worldwide during the first half of the year according to Dell’Oro, which it blames on excess inventory, weaker demand, and slower 5G deployments.

A slump in sales during the second half of 2023 extended into the first half of 2024, says Dell’Oro. It’s preliminary findings point to worldwide telecom equipment revenues across the six telecom programs it tracks – namely broadband access, microwave and optical transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP router and switch – declining 16% YoY in the second quarter of 2024.

This represents a fourth consecutive quarter of double-digit contractions, contributing to the overall decline of 17% in the first six months.

Dell’Oro describes these as ‘abysmal results’ and blames excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

The slump was registered across the board, geographically, with slower revenue growth on a YoY basis in all regions, including North America, EMEA, Asia Pacific, and CALA (Caribbean and Latin America). ‘Varied momentum’ in activity during the period was particularly significant in China apparently, where the total telecom equipment market stumbled in the second quarter, also declining 17%.

Similarly all the different types of telecoms equipment Dell’Oro tracks seems to have been impacted as opposed to one sector dragging down the numbers, with all six telecom programs declining in the second quarter. In addition RAN and MCN revenue continuing to be blighted by slower 5G deployments, and spending on SP Routers fell by a third in 2Q24, it says.

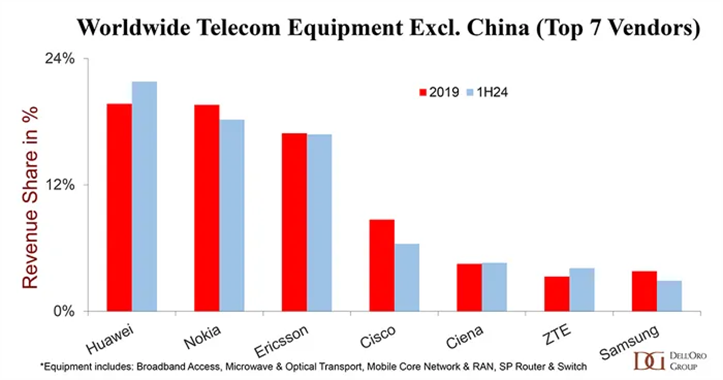

In terms of who the top players are, things were mostly unchanged. The top 7 suppliers – namely Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung – accounted for 80% of the worldwide telecom equipment market. Huawei and ZTE did see some gains – combined they clawed nearly 3 percentage points of share between 2023 and 1H24.

The analyst also points out that even with the ongoing efforts by the US government to hinder Huawei, the Chinese vendor ‘is still well positioned in the broader telecom equipment market, excluding China, which is up roughly two percentage points relative to 2019 levels.’

As for where we go from here, Dell’Oro isn’t much cheerier on the prospects of kit vendor fortunes for the rest of the year. Even with the second half expected to account for 54% of full-year revenues, market conditions are expected to ‘remain challenging’ – it’s forecasting that global telecom equipment revenues will contract 8 to 10% overall for 2024, down from the 4% decline clocked in 2023.

O artigo original pode ser consultado em: