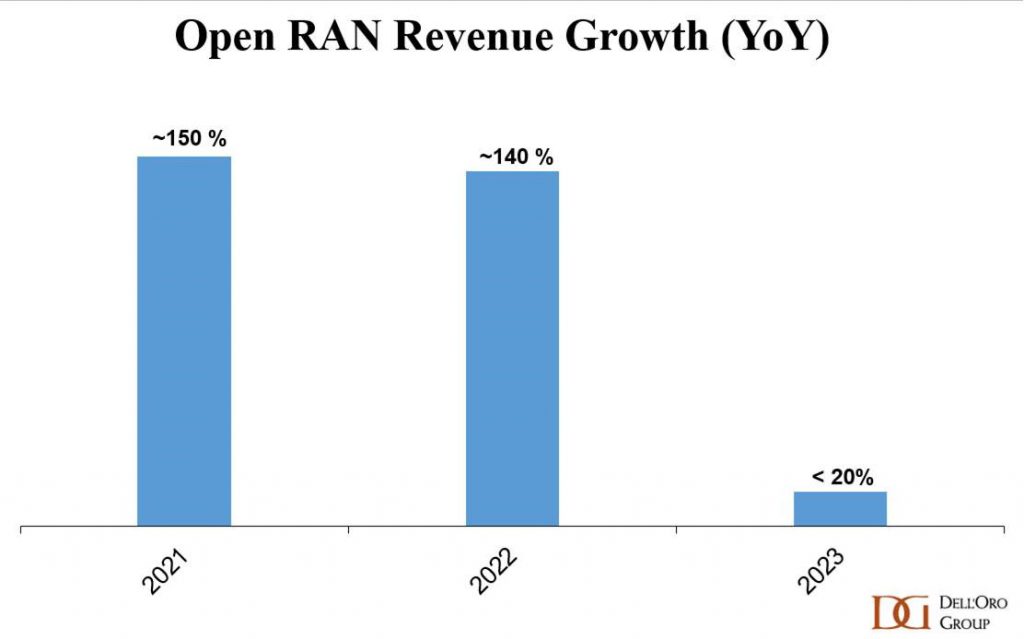

According to the latest data from analyst firm Dell’Oro, both Open RAN and vRAN revenues declined for the first time in Q2 2023.

Dell’Oro hasn’t publicly shared the precise quarterly number but the annual picture below shows the extent of the drop-off in the first half of this year for Open RAN. If this trend continues, the full year 23 growth number will likely be in the negative. Apparently we have APAC and North America to thank for the decline, with Europe still growing. The top Open RAN suppliers by revenue are: Samsung, NEC, Fujitsu, and Rakuten Symphony.

“After a couple of years where Open RAN revenues exceeded expectations and advanced at an accelerated pace, the current slowdown doesn’t come as a surprise,” said Stefan Pongratz of Dell’Oro. “Projections for 2023 were more tempered, considering that it would take time for the early majority operators to balance out the more challenging comparisons with the early adopters who fueled the initial Open RAN wave. This is the trend we are witnessing now – growth decelerated in the first quarter and declined in the second quarter.”

This seems quite early in the hype cycle for such an inflection point. Sure, exponential growth often experienced from a standing start has to slow eventually, but an outright decline at a stage when the technologies still account for such a small proportion of the overall RAN market must be a cause for considerable concern for stakeholders in those sectors. Apparently NEC is still doing OK, while Mavenir not so much.

Having said that, the overall RAN market isn’t looking too great either, so it’s possible that these emerging technologies are still outperforming the rest of the space, just. But even if that’s the case, it’s hard to extrapolate current trends such that Open RAN and vRAN even represent the majority of overall RAN spend when the 6G cycle starts, let alone dominate. Dell’Oro predicts Open RAN revenues will account for 5-10% of the RAN market this year.

O artigo original pode ser consultado em: