T-Mobile acquired a boatload of 2.5 GHz spectrum when it acquired Sprint in 2020, and it paid $304 million to win the lion’s share of licenses in the FCC’s Auction 108. Now it’s involved in a spectrum swap with SoniqWave Network to get even more 2.5 GHz spectrum.

In a recent FCC application, T-Mobile explained that it struck an agreement to swap 3.45 GHz licenses for some 2.5 GHz spectrum that’s licensed and leased to SoniqWave.

Even though AT&T and Dish Network were the big spenders in the 2021 3.45 GHz auction, T-Mobile acquired 199 licenses. It’s giving up a portion of those licenses in this transaction.

The filing describes SoniqWave as a startup wireless service provider that offers wholesale wireless broadband and private network services in various markets throughout the U.S. Its executive team is composed of several wireless industry pioneers who are well acquainted with the 2.5 GHz band.

Why it matters

T-Mobile argues that the spectrum swap is in the public interest because it will enable T-Mobile to provide improved broadband coverage and enhanced data capacity using contiguous 2.5 GHz spectrum in multiple markets – like Yuma, Arizona; Des Moines, Iowa; and Daytona Beach, Florida.

In exchange, SoniqWave will acquire 28 licenses in 14 Partial Economic Areas (PEAs) in the 3.45 GHz band. Apparently, SoniqWave believes the growing ecosystem around the 3.45 GHz band, coupled with wireless carriers that are or soon will be deploying in the band, is more lucrative for its business.

Representatives at T-Mobile and SoniqWave declined to comment to Fierce beyond what’s in the FCC filings.

T-Mobile’s rural emphasis

Of course, T-Mobile is angling for a speedy review of its application with SoniqWave, saying the FCC recently and thoroughly reviewed T-Mobile’s spectrum aggregation holdings.

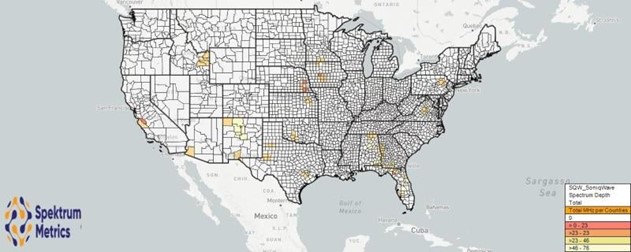

Map of SoniqWave’s EBS/BRS spectrum. (Spektrum Metrics)

The “un-carrier” points out that 247 counties in this transaction are defined as rural or partially rural. When the government approved the merger with Sprint, T-Mobile vowed to dramatically improve coverage in rural areas.

In fact, in rural areas, T-Mobile is committed to offer 5G coverage for 85% of the population in three years and then 90% in six years, and it’s made a lot of noise lately about how it’s making big inroads in rural areas.

Last week, the Wall Street Journal reported that T-Mobile and Verizon are in separate talks to carve up UScellular, which could give T-Mobile even more spectrum, albeit not 2.5 GHz, in rural areas. All the parties declined to comment on that report.

AT&T’s interest?

On social media last week, Tim McDonald, who’s history in wireless includes a stint as partner in wireless pioneer Craig McCaw’s Eagle River Partners investment firm, reposted a message from Reddit that noted none of the 3.45 GHz licenses that SonicWave has its eyes on are “impaired,” and all of them are contiguous to spectrum held by AT&T.

That means if SoniqWave and AT&T could get the FCC to remove a 40 MHz limit on 3.45 GHz spectrum holdings, “SoniqWave will almost certainly sell this spectrum to AT&T for significantly more than T-Mobile originally paid for it,” the post stated.

It’s hard to know what AT&T is going to do here – or what the FCC will allow, for that matter – but in the past, AT&T has been a vocal opponent to T-Mobile amassing more 2.5 GHz spectrum. AT&T pressed the FCC to implement a mid-band spectrum screen, citing T-Mobile’s massive holdings, before the FCC went ahead and awarded T-Mobile the licenses from Auction 108.

All we know is if T-Mobile and SoniqWave are successful, they’ll probably celebrate by going someplace far fancier than a Sonic Drive-In. But who knows? No sense in knocking the groovy fries.

O artigo original pode ser consultado em: