Though there have been nine new 5G SA networks launched since the last quarter, revenue for the Mobile Core Networks and Multi-access Edge Computing markets declined again in Q3, according to Dell’Oro.

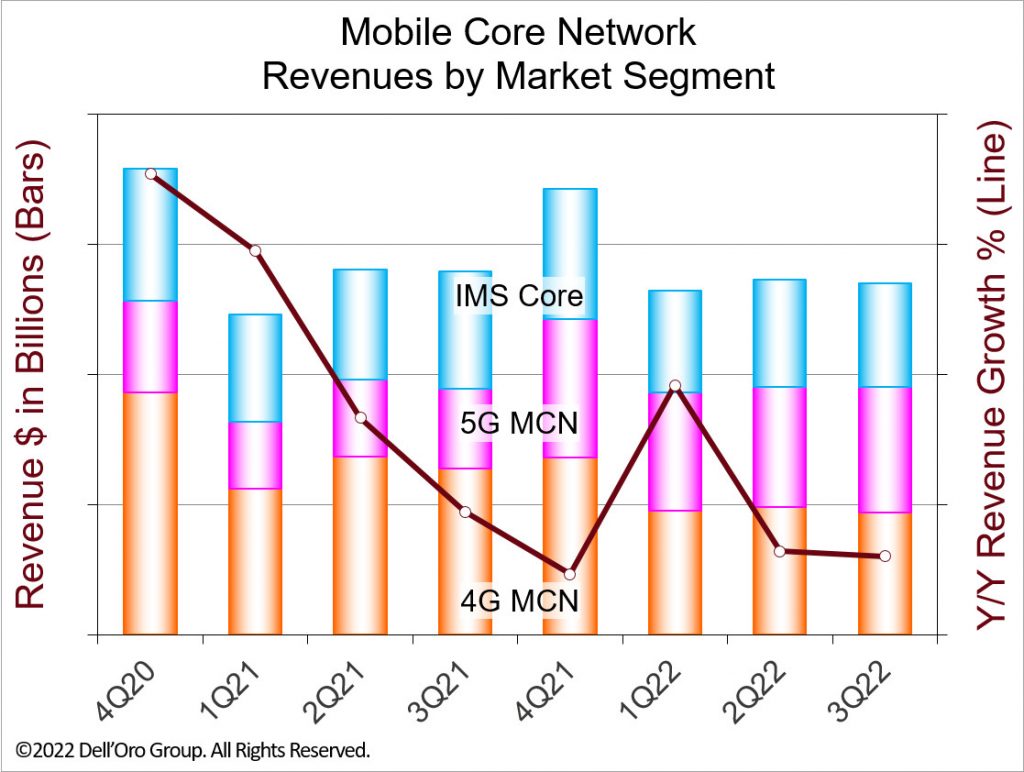

According to a new report from analyst firm Dell’Oro, the Mobile Core Networks (MCN) and Multi-access Edge Computing (MEC) market revenue declined year-on-year in Q3 2022, which means it’s the second quarter in a row to clock decline. Nine new operators launched 5G Standalone (5G SA) networks in that time – which you would think would help sales for kit vendors – but that was apparently not enough to offset the decline in 4G core markets.

“The China region had a positive year-on-year growth rate for the quarter, but it was not enough to offset the decline in the rest of the market, with the global market declining YoY,” said Dave Bolan, Research Director at Dell’Oro Group. “Even with nine new MNOs launching 5G SA eMBB (enhanced mobile broadband) networks since last quarter, it was not enough to propel the MCN market into positive YoY growth. Many of these new 5G SA networks recently launched were not country-wide, limiting the growth. In addition, the fall-off in 4G MCN and IMS Core market was more than anticipated.

“To date, we count 36 5G SA eMBB networks that have been commercially deployed. The nine new 5G SA eMBB networks that MNOs launched since last quarter include Bell (Canada), AT&T and Verizon (USA), stc Bahrain, Telekom (Germany), Optus (Australia), Claro, TIM, and Vivo (Brazil).”

Additional info come out of the report included the fact that the top global MCN vendors for the quarter were Huawei, Ericsson, ZTE, Nokia, and Cisco, and top five global 5G MCN vendors were Huawei, ZTE, Ericsson, Nokia, and Mavenir.

The long and short of all this is that while the global rollout of 5G SA networks continues to march bravely forwards, the money kit vendors are making out of selling the core equipment the new networks sit on isn’t enough to make up for the declines in 4G core sales. How big a problem that is for them would presumably depend on how much they made off the RAN for the quarter. Here’s a chart to visualise it.

El artículo original puede consultarse en: