Ninety percent of global telecom service providers believe open networks are critical to their survival. However, only 20% have an open network strategy in place, according to a survey conducted by Analysys Mason.

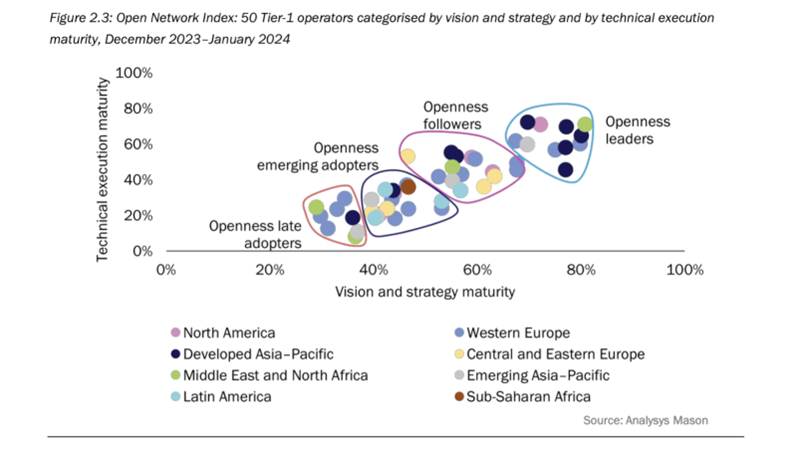

The analyst group surveyed 50 leading Tier 1 operators worldwide between December 2023 and January 2024 to form the first iteration of its Open Network Index (ONI). Analysys Mason defines open networks as those based on non-proprietary technologies and standards, including open hardware and software developed by open communities, as well as software technologies that individual vendors are exposing, typically through open application programming interfaces (APIs), to anyone who wants to use them.

The survey and report were commissioned by Dell Technologies, but Analysys Mason says it does not endorse any of the vendor’s products or services.

Dell is one of the world’s top server providers. And it’s made a concerted effort the past several years to assist telcos as they disaggregate hardware from software in their networks.

However, in 2022, Dell began offering pre-packaged multi-vendor hardware/software stacks to telcos. At the time, Dennis Hoffman, senior vice president and general manager of Dell Technologies Telecom Systems Business, said it was too difficult for telcos to pick various hardware and software from a multitude of vendors and figure out how to put it all together. So, Dell decided to offer a selection of vendor products and oversee the implementation.

Dell’s realization that totally open networks were just too much for most telcos, without support from an integrator, seems to be confirmed by Analysys Mason’s survey.

The analysts said that overall, survey respondents displayed a strong willingness to align themselves with open networking principles. But the technical implementation of open network architectures remains challenging.

The survey results placed the 50 operators into four distinct categories.

It found that openness leaders have a deep commitment to open networks and are supported at the highest levels of the organization. This category includes a higher proportion of operators from developed Asia–Pacific (APAC) than in any of the following categories.

Openness followers are implementing aspects of open networks, but they take a more tactical approach because they lack the strong level of senior executive support that the openness leaders enjoy.

Openness emerging adopters are operators that are just starting their journey. The category includes operators from developing markets that have a vision but have not yet started to deploy the architectures. The category also includes cautious adopters with lower ambitions for open networks.

Finally, openness late adopters do not have a clear concept of what an open network is, and they have not yet started to formulate a strategy for achieving openness or to win senior executive support. They have a low appetite for risk and perceive significant risks associated with moving away from incumbent vendors.

The analysts said that horizontal network cloud architectures are the gold standard for openness.

To that point, this week at TM Forum’s Ignite event in Copenhagen, executives from some major telcos talked about the importance of building network architectures horizontally as opposed to vertically.

Analysys Mason said in its report that operators should start by implementing open networks in a less-complex domain, for example, the mobile core, before expanding their approach to other domains, such as the radio access network (RAN) and edge.

El artículo original puede consultarse en: