O Encerramento 3G/2G está em curso na APAC Apanhado na Europa?

As empresas europeias de telemóveis gastaram 129 mil milhões de dólares na compra de espectro 3G no início do novo milénio. Chegou a altura de a3ª geração de tecnologia móvel desistir?

Following in the wake of all major USA networks, Telenor Norway, VodafoneZiggo in the Netherlands, Vodafone Italia, and Airtel India, BT (the owner of the UK mobile provider, EE) is the first UK operator to set a time frame for the phase-out of 3G. It intends to sunset this older network over the next two years to free up airwaves to help bring 5G to the entire country by 2028.

Desde o seu lançamento em 2001, a 3G foi revolucionária ao dar vida aos primeiros smartphones, tais como o iPhone, e ao permitir dados móveis. A sua introdução marcou uma transformação na tecnologia móvel, mas foi agora suplantada pelos seus sucessores mais avançados.

Para melhor suportar uma elevada utilização de dados e para reduzir os custos associados ao funcionamento de múltiplas redes, muitos operadores estão a pôr em funcionamento redes antigas para reduzir os custos e melhorar a capacidade para novas tecnologias.

Porquê a necessidade de desmantelar redes legadas

Os operadores da região Ásia-Pacífico estão a liderar a racionalização da rede herdada. Começaram a racionalizar os seus serviços 2G já em 2008 a 2012, e muitos outros seguiram-no mais recentemente.

Os operadores de redes móveis chegam a esta decisão por uma vasta gama de razões. À medida que tecnologias mais eficientes se tornam disponíveis e a natureza da procura dos consumidores muda, os operadores de redes móveis procuram racionalizar os serviços de rede herdados.

As principais razões são um impulso para reduzir custos, uma falta de procura das redes mais antigas, juntamente com a necessidade de libertar espectro para melhor acomodar tecnologias e serviços da próxima geração.

Supporting the future with 5G

Demand for 5G is forecast to grow exponentially.

5G networks will enable us to move even more data at speeds well beyond the capabilities of existing 4G LTE networks, and will enable new applications such as augmented reality and virtual reality to expand and become more accessible.

5G will enable many new and cutting-edge applications, which will require high reliability and low latency such as self-driving cars, factory automation, and remote surgery.

Demand for 5G is forecast to grow exponentially. According to BT Consumer CEO Marc Allera, demand for mobile capacity is rising by 40% every year, and BT has switched on its 5G network in 160 towns and cities since it launched in 2019.

Traffic had more than quadrupled on its 5G network since October when the 5G-enabled iPhone 12 launched, he said.

Forecasts suggest that by the end of 2021, global 5G subscriptions will reach 580 million (Ericsson Mobility Report June 2021) and by 2025, 5G networks are likely to cover one-third of the world’s population (gsma.com).

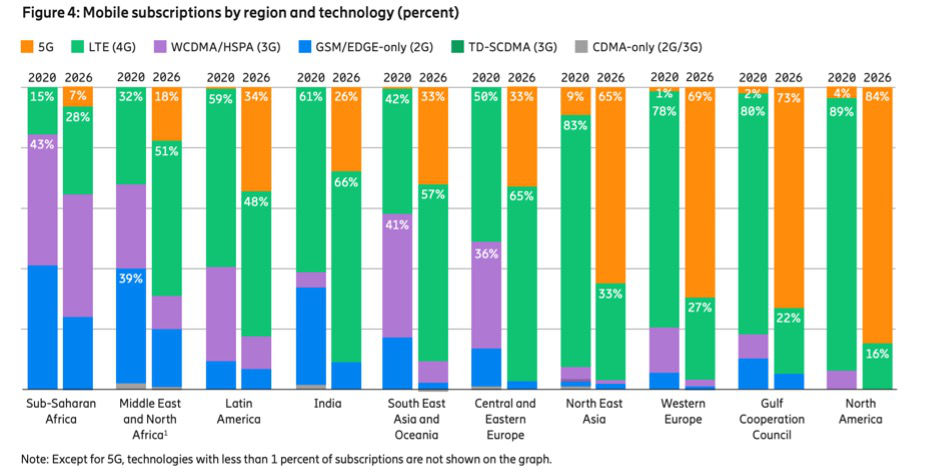

Fonte: Relatório de Mobilidade Ericsson Junho 2021

However, as the world continues to innovate and create more capable devices, the demand for spectrum increases as well. To reap the benefits of 5G and the networks of the future, the nations must have forward-looking strategic policies to make spectrum use more efficient and make more spectrum available.

5G-enabling technologies

Arguably, the most important thing that distinguishes 5G from other networks is its flexibility and adaptability, required to meet the needs of the diverse applications that 5G is intended to support.

While some 5G deployments are in new mobile broadband frequency bands, such as 3.5 GHz (C-band), mobile operators must have the freedom to re-farm existing spectrum holdings to 5G, notably to deploy a 5G coverage layer, in response to market demand.

Coming back to the recent announcement by BT in the UK … BT has laid out its network evolution plan for the coming decade, with a roadmap that sets it on course to offer more than 90% of Britain with 5G service by 2028. It also hopes to have key infrastructure converged by this deadline.

If BT can meet its goal, it will be impressive: It is saying that a 5G connection will be available anywhere in the UK, including hard-to-reach places, such as remote areas of Wales and Scotland. Most of the connections will be available from its macro network, but where that cannot reach, BT is pledging to make 5G on-demand using portable or roving base stations, drones, or high-altitude platforms (HAPS).

Qual a primeira: 3G ou 2G?

Uma decisão chave é se primeiro se deve desligar a rede 2G ou 3G. Esta decisão dependerá de vários factores e haverá soluções diferentes para cada região.

Alguns operadores/mercados estão a pôr 2G em primeiro lugar, por exemplo, operadores no Japão, Taiwan, Singapura, Coreia do Sul, e Hong Kong, juntamente com outros mercados asiáticos, já desligaram as suas redes 2G.

Na Europa, é provável que a 3G seja a primeira, mas será depois seguida pela 2G. O factor-chave é evitar a "rotatividade" do cliente, e terão sido efectuadas análises para determinar a distribuição dos aparelhos em uso, a fim de calcular se o desligamento de 2G ou 3G teria o maior impacto.

Os planos de desmantelamento dependem de vários factores, tais como o número de clientes e a quantidade de tráfego gerado através de dispositivos 2G/3G, juntamente com requisitos contratuais, particularmente em torno da conectividade Internet das Coisas (IoT) ou Machine to Machine (M2M). Por exemplo, a iniciativa de contadores inteligentes do governo britânico funciona na rede 2G, tal como os dispositivos como os terminais de pagamento no ponto de venda.

Há também requisitos regulamentares a considerar. Por exemplo, desde 2018, os regulamentos da UE têm exigido que os veículos a motor sejam equipados com a capacidade de fazer chamadas de emergência baseadas no 112, e muitos utilizam tecnologias 2G e 3G para o fazer.

Os fornecedores de telecomunicações necessitam frequentemente de manter redes tradicionais 2G/3G para suportar serviços de voz onde estes ainda são fornecidos em modo de circuito comutado porque, em teoria, a tecnologia 4G não suporta este modo.

Uma solução mais eficiente para serviços de voz do que 2G ou 3G pode ser entregue utilizando a tecnologia Voice over LTE. Mas em áreas onde isto não é viável e uma rede herdada precisa de ser retida para serviços de voz, a 2G fornece uma tecnologia eficiente para a entrega de serviços de voz.

Em geral, a 3G será desactivada antes da 2G na Europa, e potencialmente em África, por uma série de razões, nomeadamente:

- 2G é uma tecnologia eficiente para fornecer serviços de voz, com uma eficiência espectral semelhante à 4G para serviços de voz, enquanto que a 3G é significativamente inferior à 4G como um serviço combinado de voz e dados.

- 2G services can be squeezed down into smaller bandwidths (multiples of 2x200kHz) whereas 3G comes in multiples of 2x5MHz, therefore it is easier to fit a legacy 2G service alongside a later technology within an existing band. For example, if an operator has 2×17.5MHz of 900MHz spectrum, as in UK, then you could have a legacy 2G service in 2×2.5MHz and use the other 2x15MHz for 4G or 5G.

- Os serviços 2G terão geralmente uma cobertura superior à 3G (onde o primeiro é fornecido acima dos 900MHz e o segundo acima dos 2100MHz). Uma rede legada que utilize 2G pode, portanto, manter uma melhor cobertura para esta rede legada.

- Questões de IdC antigas - um problema devido aos dispositivos estarem fora da rede e não serem tão facilmente substituídos da forma que um consumidor pode simplesmente actualizar para um dispositivo móvel mais recente. Em muitos mercados, existem mais dispositivos IoT em 2G do que em 3G.

O que é que isto significa para os clientes?

As mentioned above, operators as well as regulators are concerned about service continuity for customers who have not yet acquired a 4G or 5G device.

Estas questões são particularmente preocupantes nos países em desenvolvimento e de menor rendimento, onde são frequentemente os mais pobres que são afectados por interrupções de 2G ou 3G. No entanto, os reguladores podem utilizar mecanismos para manter um serviço mínimo, tais como a utilização do Fundo do Serviço Universal para pagar a um operador para manter uma camada fina de 2G em funcionamento, possivelmente com outros operadores a acederem a esta rede GSM, ou através do financiamento de um programa para substituir o equipamento antigo 2G/3G.

Para além da utilização de aparelhos móveis, 2G e 3G são utilizados para dispositivos como contadores inteligentes, sistemas de chamadas de emergência, carros ligados, e unidades telemáticas. Outro exemplo é o e-reader da Amazon, Kindle. Cada modelo Kindle fabricado antes de 2017 só tem acesso à Internet 3G e enquanto alguns Kindles 3G também têm Wi-Fi, mas nem todos têm.

As boas práticas para apoiar a transição dos clientes incluem:

- Um período de transição de cerca de três anos, com os preparativos a começarem antes dos anúncios públicos formais

- Uma compreensão das necessidades do cliente e oferta de orientação sobre como se preparar para uma transição

- Um prazo de pré-aviso razoável com base nas circunstâncias do mercado e compromissos contratuais

- Incentivos para os clientes actualizarem (tais como preços baixos para novos dispositivos de consumo) sempre que possível

- Educar os clientes com toda a informação necessária para que possam planear adequadamente

O espectro é a chave para futuras redes

Para os operadores e reguladores, é importante compreender a necessidade de espectro e como as suas redes mais antigas podem ser transitadas para ajudar a preparar o caminho para novas tecnologias.

As the world continues to innovate and create devices that are more capable, the demand for spectrum increases as well. To reap the benefits of 5G and the networks of the future, nations and operators must have forward-looking strategic policies to make spectrum use more efficient and make more spectrum available.

Saiba mais

Para saber como poderão ser estas políticas ou se estiver interessado nos nossos serviços como consultor sobre este tópico, contacte-nos por favor. Gostaríamos de falar mais consigo.

International 5G News Service

Keep up to date with the latest news from around the world relating to 5G developments. Get it delivered directly to your inbox by subscribing to our email service.