5G might not have lived up to all its expectations yet when it comes to proliferating the technology across industries/enterprises and connecting the machines. However, when it comes to human-driven 4G+ based mobile broadband applications, the suppliers are now starting to realize that one of the near-term challenges they are facing is simply that 5G is actually too good.

With worldwide wireless operator revenues projected to grow at a 1% CAGR over the next three years and major RAN suppliers outside of China on track to reduce a third of their workforce relative to 2017 levels, some clarification is perhaps warranted.

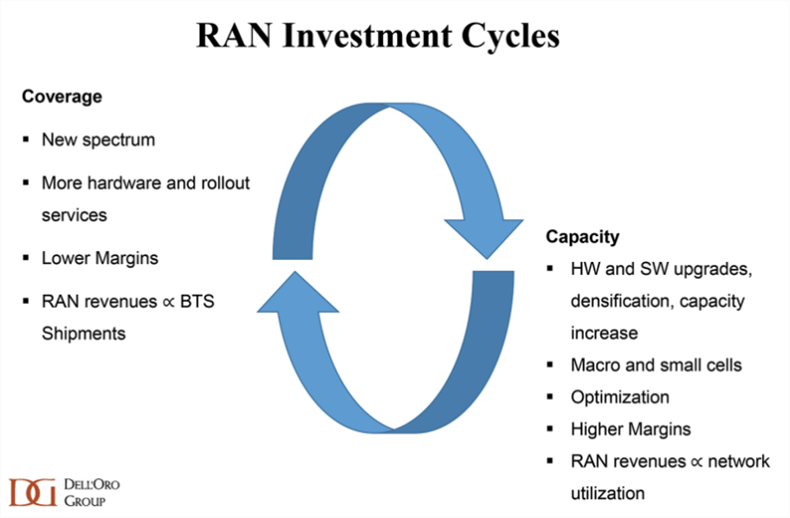

At a high level, RAN investments can be divided into those focused on coverage and those focused on capacity. For the ones that missed slide 10 from Ericsson’s 2016 Investor Day presentation, it is a good reminder that during the coverage phase, RAN revenues tend to correlate with Base Transceiver Station (BTS) shipments. On the other hand, in the capacity phase, revenues are more tied to network utilization and data traffic growth.

Currently, the RAN infrastructure market is approaching the $35 billion to $40 billion range, encompassing both coverage and capacity investments. New BTS shipments form the foundation of the coverage phase, constituting a significant portion of the overall RAN market. Simultaneously, the capacity cycle and recurring upgrade revenues also contribute substantially to the overall RAN capex. During the 4G era, cumulative software and hardware upgrade revenues over the life of a typical base station exceeded the initial equipment capex.

What is complicating the situation with 5G is that the ratio between coverage and capacity-based capex is changing relative to previous mobile technology cycles, in part because of the disconnect between current network utilization levels and data traffic growth rates.

In the early part of the LTE era, mobile data traffic was advancing exponentially and the 10 MHz channels with 4G did not provide that much incremental capacity relative to HSPA+, spurring operators to ramp carrier aggregation deployments to increase the combined frequency bandwidth. Now in the 5G era, data traffic is growing in the 30% range and the baseline projections are for mobile data traffic to increase at a 25% CAGR over the next five years (including FWA and AR) per Ericsson’s Mobility Report.

But the upper mid-band boost is significant, in some cases more than doubling the overall capacity depending on existing spectrum assets. Consequently, the 5G coverage cycle is likely to surpass 4G RAN in revenues to accommodate the increased number of frequencies. However, the timing for capacity upgrades beyond the initial coverage phase remains uncertain, potentially affecting the capacity share of overall 5G RAN.

Network utilization levels and data traffic growth rates did not impact the RAN market much in the initial 5G phase. But as the 5G POP coverage improves and the advanced markets become more dependent on upgrades, network utilization levels and data traffic growth rates will gradually move from the back seat to the driver seat.

With China Mobile and China Unicom reporting that their combined handset traffic increased 11% YoY in 1Q24, there is downward risk given current baseline projections. Additionally, the successful introduction of a new mobile AR device for the masses could accelerate cellular-based AR growth more than anticipated (currently projected to account for 10% to 15% of total mobile traffic by 2028, according to Nokia’s 2023 Investor Update).

In summary, 5G has so far delivered mixed results when evaluating not just its technical performance but also the broader business impact and its ability to contribute to new value creation across industries. While the upper mid-band spectrum combined with Massive MIMO has significantly expanded the capacity and improved RAN economics, the ongoing supply-demand disconnect and evolving coverage/capacity RAN revenue ratio relative to previous mobile technologies may pose larger challenges for suppliers as the transition towards the capacity phase continues.

In other words, more data traffic growth is needed or there is a risk that 5G coverage/5G capacity > 4G coverage/4G capacity.

Original article can be seen at: