Four years ago, a customer asked me for my forecast on network slicing. I laughed and said “I’m not publishing a forecast because it’s a boring chart: Zero for the next five years.” That has been accurate, more or less.

But today, the picture is starting to change, and Mobile Experts just released some not-so-boring charts that lay out the future of managed services, network slicing and other services related to private cellular.

Maybe the central insight to all of this is that adoption of network slicing is a new business model, not just a new technology. The technical concept was pretty clear in 2019, but people weren’t ready to adopt it. Psychology trumps engineering, at least until the engineers can make it simple enough and easy enough.

Here’s our run-down on the changes over the past four years, based on dozens of interviews with operators, managed service providers, enterprises, hyperscalers and others:

- Competitive change: Four years ago, heated arguments would break out between the Wi-Fi supporters and the private LTE crowd. Wi-Fi supporters would argue that their solutions had similar bandwidth and reliability. Today, enterprises are coming to a consensus that cellular simply works better in terms of RF link budget and the associated capacity, reliability and predictable latency.

- Availability of devices: LTE devices are widely available, and the adoption of private LTE in enterprise networks is happening at a steady pace. One example: In the logistics market, private LTE network equipment revenue is growing by 59% this year. But private 5G networks for logistics are growing by 95% this year, because the devices are now available. (See our report for details on 13 different verticals)

- Software maturity: Multiple software layers need to be mature for the use cases to take root. We’re focused on the application software for edge applications, which need some kind of local network connectivity. This is happening with AGVs, mining equipment, oil & gas applications and some manufacturing cases. So far, these applications have been served by private “do-it-yourself” (DIY) networks, because these early applications involve big companies that insist on data sovereignty. But the maturing software can now be applied for smaller customers that would prefer a managed service of some kind.

- Automated configuration: Looking specifically at network slicing, the RAN configuration and orchestration software was not ready four years ago. In 2019, an operator told me that setting up a network slice would take them over a month, with multiple people working full time to configure individual network elements. That process has been automated now. The best examples are in China, where ZTE software can set up a network slice with one person clicking a few options for a few minutes.

- SA core network investment: To sell private network services successfully, the operators need to invest in stand-alone (SA) core networks. This has been a chicken-and-egg problem, since the operators are waiting to see SA revenue before they invest. Keep in mind that the ROI for the operator depends on local instances of the SA core network (or at least key UPF functions), so that the operator can sell connectivity services with service level assurance.

- Technology: One of the hurdles to making network slicing effective is that real-time optimization must be done in real time. If the operators want to charge more for a premium service, or charge more for guaranteed performance for a group of users, the RAN has to recognize the app or the user somehow. We’ve seen some new AI tools that manage this without planting a core network in every cell site.

- Psychology: The operators are hesitant to offer guarantees. Proof-of-concept trials are going well, but executives in the top MNOs need to make a leap of faith and start offering guaranteed resources for a premium price. I believe that this is the biggest transition on my entire list and the most critical change. Recent test results indicate to me that network slicing can work, and operators can start charging for many kinds of premium services, including diamond/gold users, premium apps and guaranteed throughput/latency in private slices or private dedicated networks.

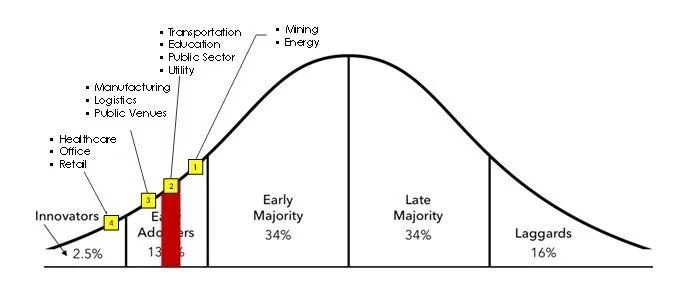

I have been shouting for years that the future of mobility is NOT in faster speeds. Nobody cares about faster speeds anymore, and even the consumers see it by now. So we are entering a new market, and Geoffrey Moore’s famous process of “Crossing the Chasm” applies here. We believe that a few private cellular markets have already crossed over to become “mainstream” markets, and a few more are jumping the chasm this year. Network slicing for the leading vertical sectors will follow the growth in revenue now, because operators can safely invest in the SA networks.

Again, in 2019 I was forecasting zero revenue for network slicing. Today, I’m expecting to see network slicing grow to at least 40% of the managed services market. Our new report is forecasting $3.6 billion in revenue for private cellular managed services over the next few years, and soon we expect a sizable portion to come from network slicing, with other MSP revenue supporting dedicated on-prem radios in various ways.

If the operators really want to be relevant in the private cellular market, it’s time for them to bolster their courage, use the new technology, and commit to premium performance guarantees.

Original article can be seen at: