Heavy machinery manufacturers are lagging other sectors when it comes to the deployment of Industry 4.0 solutions.

This is according to a survey published this week by Nokia, as part of its ongoing effort to stimulate Industry 4.0 adoption.

The Finnish kit maker is on a mission to get the industrial and manufacturing (I&M) sector to accelerate its digital transformation, rolling out a steady stream of new Industry 4.0 hardware and software solutions.

Just last week, it added four third-party apps to its MX Industrial Edge platform, from Atos, industrial edge specialist Litmus, streaming analytics provider Crosser, and cybersecurity firm Palo Alto Networks.

In February, Nokia extended its partnership with IT infrastructure giant Kyndryl by three years. Together the companies are working on LTE and 5G private networking, a partner innovation lab, and yes, Industry 4.0 solutions.

Last September, it added support for non-cloud native workloads to its Mission Critical Industrial Edge compute solution.

On Monday, Nokia revealed how it has been trying to benchmark Industry 4.0 progress with what it calls its ‘maturity index’, which highlights which sectors within the broader I&M vertical are doing better than others when it comes to digital transformation.

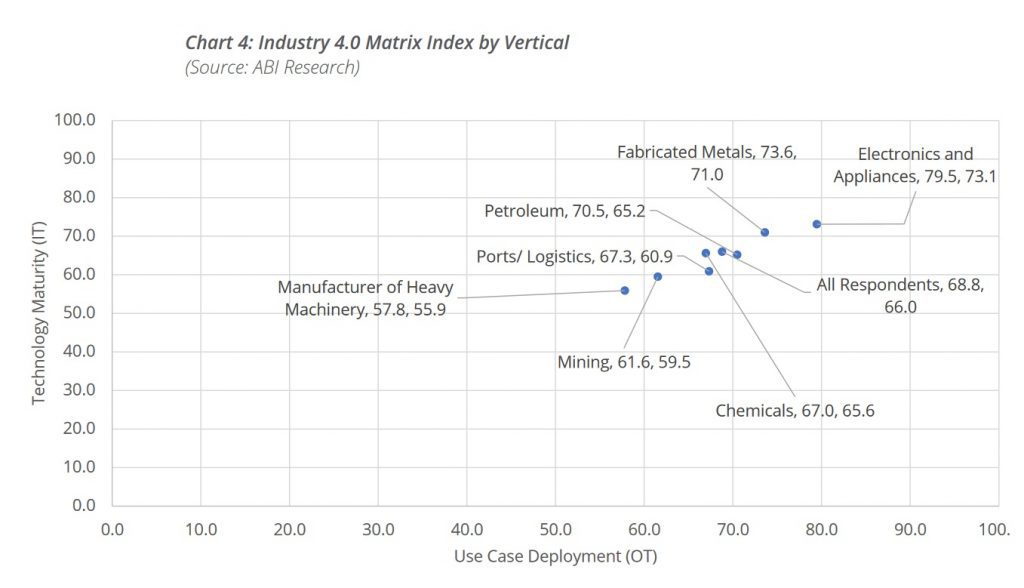

Together with ABI Research, Nokia quizzed IT and operational technology (OT) leaders at 500 companies spanning a broad swathe of industrial sectors, based in either France, Germany, Japan, the US, or UK. The questions focused on how far along they are with deploying various IT, networking and OT systems. These include but are not limited to private cellular networks, cloud and edge infrastructure and applications, augmented/virtual reality (AR/VR), automated guided vehicles and drones and so-on.

Based on their answers, respondents were awarded two scores – one for technology maturity, the other for use case deployment – with a maximum possible score in each category of 100. So, a factory that has rolled out a private 5G network across multiple sites and is using it to automate production processes and enable predictive maintenance, for example, will get much higher scores than a rival that has just about got round to installing its first Wi-Fi access point and is considering a second one in the next 5-10 years.

“The survey findings show that I&M firms are rolling out 4G networks and 5G networks. Often they have already made investments in Wi-Fi across their facilities. Firms have also been scaling cloud applications and supporting remote workers with mobile devices,” said Nokia, in a whitepaper accompanying the survey.

Ideally, companies should achieve similar scores in both categories, because that demonstrates close alignment between the IT and OT sides of the business.

“Upgrades to IT infrastructure should be synchronised with the use cases being deployed. Additional use cases will place an extra load on the IT infrastructure, risking poor performance. Alternatively, spare IT capacity wastes scarce budgets,” Nokia said.

Electronics and appliance makers appear to be leading the way, with use case and tech maturity scores of 79.5 and 73.1 respectively, way above the average across all respondents of 68.8 and 66.0 (see chart below). By comparison, the heavy machinery manufacturing sector has some catching up to do, with scores of 57.8 and 55.9.

It is easy to be sceptical of surveys that attempt to distil an entire industry’s digital transformation strategy into a number – or in this case two numbers – between 0 and 100, which is partly why Nokia and ABI Research have launched a self-assessment tool. Anyone can take the same survey to see how their business stacks up.

It goes without saying that the survey will inform Nokia’s sales strategy too.

“As the global leader in private wireless and industrial edge across an array of industry sectors, we want to simplify and accelerate digital transformation for industries,” Stephan Litjens, VP of enterprise campus edge business at Nokia, in a statement. “The industry 4.0 maturity index and self-assessment tool help industrial campuses to understand where they are and how to progress. We see investments scaling up this year, and this is confirmed by this research that shows that industries are, on average, moving closer to aligning IT and OT.”

Original article can be seen at: