Tareq Amin abruptly departed today as the CEO of Rakuten Mobile and Rakuten Symphony.

Rakuten Mobile announced that Kazuhiro Suzuki and Sharad Sriwastawa would act as Co-CEOs of the mobile carrier.

Rakuten Symphony, which is a subsidiary of Rakuten Mobile, announced that Rakuten Group CEO Mickey Mikitani has taken over as CEO of Symphony and Sharad Sriwastawa has become Acting President

The news shared from Rakuten was very brief, but the company said the new management structure is effective today.

For his part, Amin posted on LinkedIn: “During my time at Rakuten, I am proud to have been part of a team that has disrupted the industry and left a lasting impact on the world. We have challenged the status quo and pioneered new approaches that have transformed the way telecom networks are built, architected and operated.”

Amin didn’t indicate that he was immediately moving to another company. He said, “I am eager to channel my energy and attention towards creating cherished moments and nurturing bonds that matter most in life – my children.”

Next Curve analyst Leonard Lee said Amin “has been kind of the poster child for open RAN, a real pioneer.”

He added, “This is really a sore loss for the movement. It’s a regrettable loss for the industry. He’s been a really prominent spokesperson for the standards and the advancement of the technologies. If it wasn’t for Tareq and Rakuten Mobile, open RAN would not be where it is today.”

Lee also noted that Rakuten Symphony has created a workable framework for how all the parts and pieces of open RAN networks can work together.

The problem with profits

While Rakuten Mobile has advanced open RAN and virtualized networks, the company has not earned a profit. And analysts have been hard on it for that reason. Last year, Amin predicted the business would break even in 2023. But the company seemed to back off that assertion this year.

Rakuten reports its Q2 2023 earnings later this week. But after its Q1 earnings, New Street Research analyst Chris Hoare wrote, “There is no magic to building a mobile business; it requires capital and time. Rakuten is increasingly out of both.”

Around the time of its Q1 earnings, Rakuten Mobile struck a new roaming deal with the large Japanese incumbent KDDI. Hoare wrote that the deal was unlikely to help Rakuten financially. “KDDI is highly unlikely in our view to be offering a wholesale deal at a price that undermines its own business model,” he said.

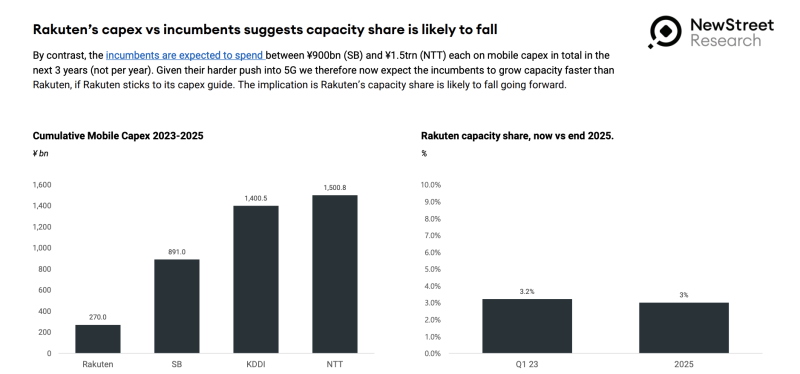

The New Street analysts also noted that Rakuten is guiding to very limited capacity increases, which will prevent it from gaining significant market share in the Japanese market.

Amin was always very determined for Rakuten Mobile to cover 100% of Japan. But Lee said, “What they’ve accomplished in populated areas, covering beyond 95% of the country is a pretty great accomplishment in itself. Getting 100% coverage would be a differentiation. But how much? For a telecom’s business, it’s not a compelling statement. The question is how are you monetizing the 95% you do cover?”

Rakuten Symphony

Meanwhile, Rakuten Symphony has struggled to gain traction, as well.

In August 2021, Rakuten Symphony was hired by 1&1 to build a fourth mobile network in Germany. “Together with Rakuten, 1&1 will build Europe’s first fully virtualized mobile network based on innovative open RAN technology,” the companies stated at the time.

But since then, Rakuten Symphony has gained only a few other named customers, including just last week a deal with VEON to explore cooperation in Ukraine to rebuild the country’s telecom infrastructure with open RAN technology and digital services.

Original article can be seen at: