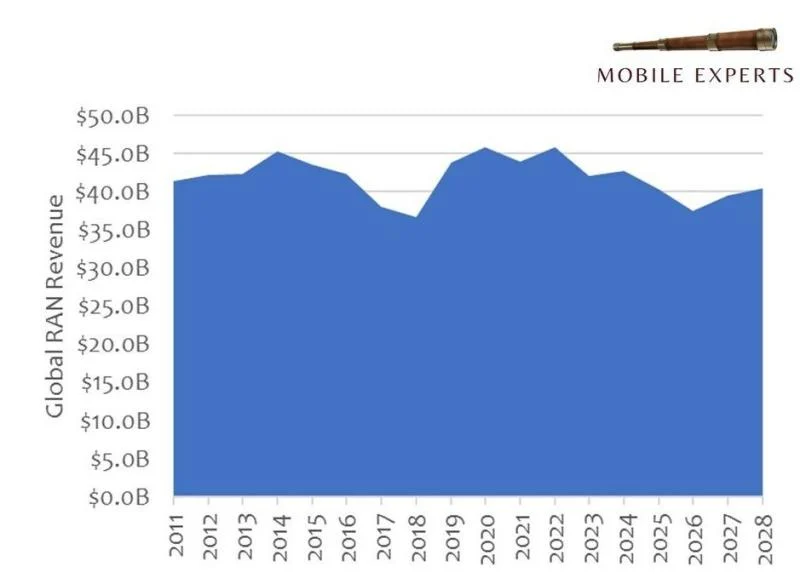

A new report from Mobile Experts forecasts that 5G Radio Access Network (RAN) investments will decline over the next few years before 6G forces another ramp up.

The general direction tracks with reports from Dell’Oro Group, which also recently published a report noting the RAN market is transitioning from the expansion phase to one of slower growth.

Ericsson is leading the race in the vendor space, with Nokia taking the No. 2 position, pulling far ahead of Huawei, according to Mobile Experts.

Interestingly, Mobile Experts’ new forecast shows how China and the rest of the world have become entirely separate markets.

While Chinese operators will work to meet their government’s expectations of 5G development over the next two years, the United States and other countries will experience a decline in 5G investment, the firm stated.

“We’ve seen this pattern many times, in 2000, 2008, 2016 and now 2023,” said Mobile Experts chief analyst Joe Madden in a statement. “The second half of every ‘G’ involves significant reductions in base station pricing, as well as shifts in volume. Every ‘G’ migrates from a growth opportunity to a cash-cow opportunity. This time, we have some interesting shifts toward software and private 5G at the same time, which offset the natural decline of the market.”

Capex and RAN

Indeed, all the major U.S. carriers have adjusted their capex, but capex is only one of the factors Mobile Experts considers when making its projections. In fact, capex estimates are not a very good indicator for the RAN market, according to the analysts.

That’s because capex is reported at a high level by global operators, typically including both wireline and wireless business areas into a single capex estimate. The lines between wireline and wireless are blurred, as fiber is used in both areas, and each company will account for mobile capex and RAN-related capex in a different way, Mobile Experts explained.

In addition, depreciation and accounting for network vendor financing can skew the results. Therefore, Mobile Experts uses capex only to double-check against their modelling of capacity in the network and their forecasts at the product level for future spending. “The capex view is not the original source of anything in our model,” the firm stated.

What it does use to make forecasts is data collected from multiple component vendors. They use this information to triangulate the correct number of radios shipped each quarter. Power amplifiers, crystal oscillators, filters and other components are used as reference points. And it’s helpful that each country uses different frequency bands so they can track shipments of frequency-sensitive components and break out China and other countries.

Original article can be seen at: